[Bitop Review] Strategy Shares Hit Record 6-Month Losing Streak Despite Bitcoin Accumulation

2026年01月02日发布

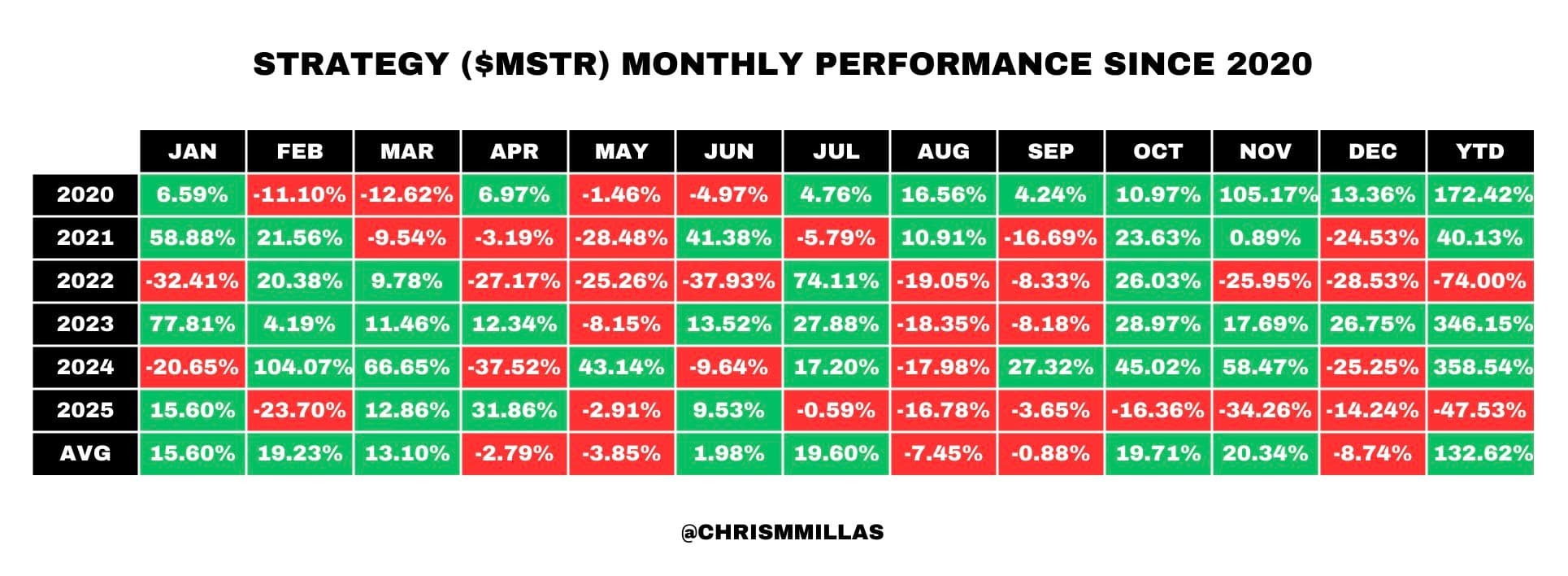

Strategy (MSTR) has recorded its first six-month losing streak since adopting Bitcoin as a treasury asset in 2020. According to data shared by crypto analyst Chris Millas, the firm’s stock suffered uninterrupted losses throughout the second half of 2025, breaking its historical performance patterns.

Unprecedented Market Slump

For the first time in over four years, Strategy shares declined for six consecutive months, from July through December 2025. Analyst Chris Millas highlighted the severity of the drop in a January 1 post on X:

August: -16.78%

October: -16.36%

November: -34.26%

December: -14.24%

As of December 31, the stock closed at $151.95. This represents a 59.30% decline over the past six months and a 49.35% drop over the past year.

A Break from Historical Patterns

This downturn differs significantly from previous bear markets. In 2022, sharp declines were typically followed by rallies of over 40% within a few months. However, the second half of 2025 saw no such relief rally. This absence of a rebound suggests a persistent repricing of the stock rather than a temporary selloff.

Divergence from Bitcoin and the Broader Market

Strategy's poor performance occurred despite the broader market rising—the Nasdaq 100 gained 20.17% in 2025—and Bitcoin holding up relatively better than MSTR stock.

Bitcoin Performance: As of January 1, Bitcoin traded at $87,879. It is down roughly 9.65% over the past year, performing significantly better than Strategy's stock.

Continued Accumulation: The divergence didn't stop the firm from buying more. On December 29, Executive Chairman Michael Saylor announced the acquisition of 1,229 BTC for approximately $108.8 million.

Total Holdings: As of late December, Strategy held 672,497 BTC, acquired for a total cost of roughly $50.44 billion.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.