[Bitop Review] Crypto Technical Analysis: BTC, ETH

2025年07月16日发布

BTC

After approximately two months of consolidation, BTC has finally broken out of a flag pattern, reaching a new all-time high of $123,218. Yesterday, the price slightly declined and found support near $115,736, roughly equivalent to the Fibonacci 0.707 level.

A rebound at the 0.707 level is typical bullish behavior. As of writing, the price is temporarily at $117,650. Investors can consider entering a long position at the current market price. A more conservative strategy would be to wait for a pullback to the 0.618 level. Entry price is around $113,600, with take-profit levels set in stages at $123,000, $130,000, and $147,000. The stop-loss can be placed below $110,300.

Reference Levels:

Direction: Long

Entry: $113,600

Take-Profit: $123,000 / $130,000 / $147,000

Stop-Loss: $110,300

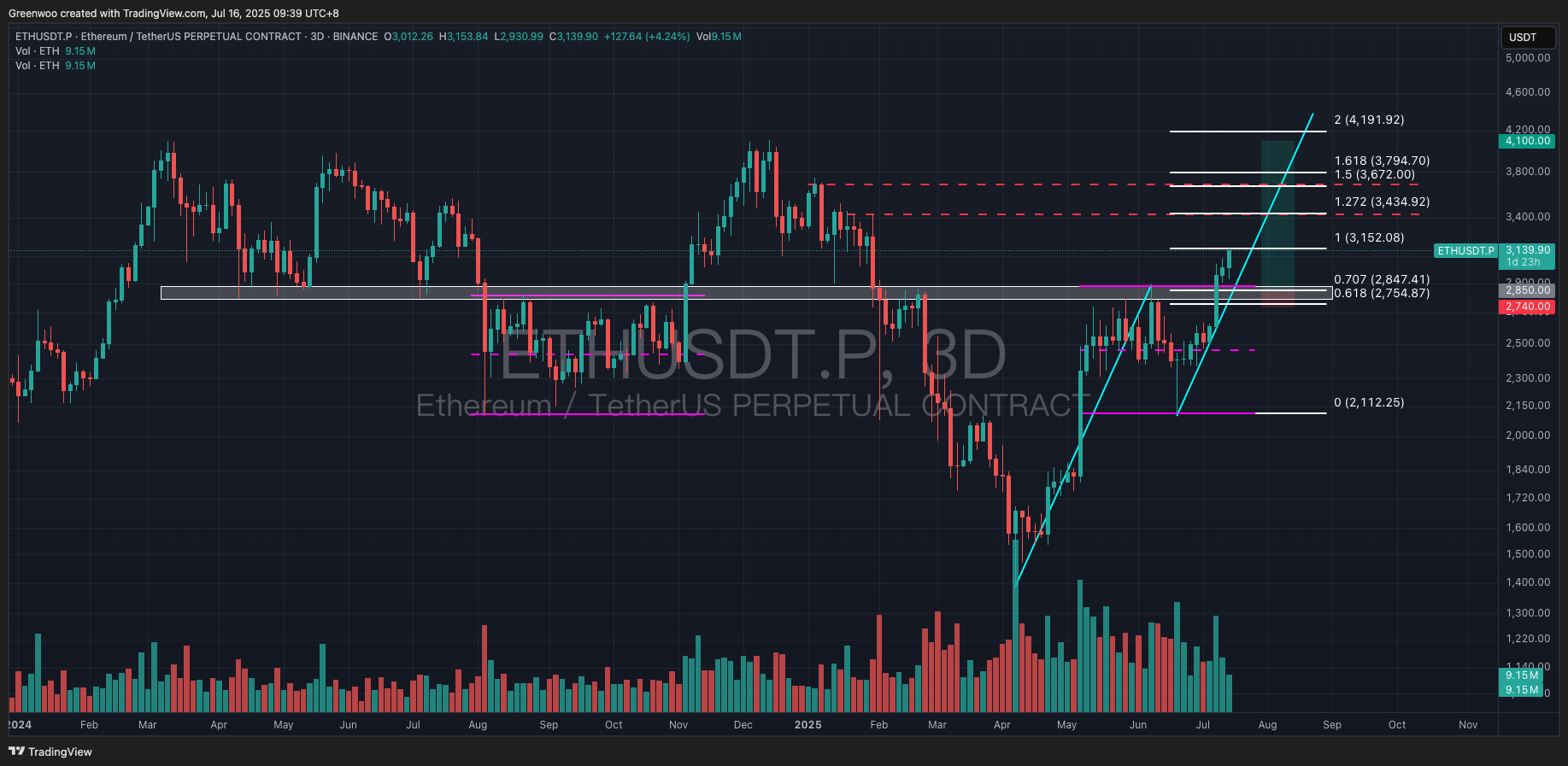

ETH

ETH has recently shown strong upward momentum, breaking out of a trading range and temporarily peaking at $3,150. As of writing, the price is at $3,137.

Historical price action shows that the trading ranges from August to November 2024 and May to July this year are nearly identical. Prices have consistently faced resistance or found support within the $2,800 to $2,880 range. The Fibonacci 0.707 level, approximately $2,850, also aligns with this range.

If the price pulls back, it is expected to find support in this range, providing an opportunity for investors to enter long positions. Take-profit targets are set at $3,430, $3,670, and $4,200. The stop-loss can be placed slightly below the support range, around $2,740.

Reference Levels:

Direction: Long

Entry: $2,800 - $2,880

Take-Profit: $3,430 / $3,670 / $4,200

Stop-Loss: $2,740

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.